Value Decoder framework

A framework for turning perceived customer value into a defendable price band by anchoring on the next-best alternative and adjusting for context.

Snapshot (TL;DR)

What it is

The Value Decoder is a structured framework for turning perceived customer value into a concrete price by benchmarking against close substitutes and layering in key "adjusting forces" such as income, complements, and environment.

Why it matters

- Forces you to think like a customer instead of anchoring on cost-plus pricing or arbitrary margins.

- Makes "value-based pricing" operational (from fuzzy concept → specific price range you can test).

- Highlights where you can charge a premium (or must discount) and how external changes should trigger price updates.

When to use

- Pricing a new product or feature where clear substitutes exist; re-pricing an existing offer in a changing market (inflation, new competitor, demand shock).

- Deciding how much premium you can justify vs. a competitor for "good / better / best" packages.

- Educating non-pricing stakeholders (founders, PMs, sales) on value-based pricing logic.

Key Takeaways

Value is a Subjective Tradeoff: The framework defines value as a highly subjective judgment based on the tradeoff between perceived benefits and perceived price, meaning your product's "worth" can vary significantly from one beholder to another.

The Volatility of the Market Environment: A product's value is fickle and can be instantly altered by external variables such as fads, new information, timing (e.g., seasonality), or unexpected market events.

Interdependence of Related Products: The value of your offering is influenced by the price and demand of complementary goods; for instance, rising costs in a related service can lower the perceived value of your core product.

Empowerment via Internal Transparency: Presenting a Value Decoder analysis to the entire organization builds a "culture of profit" by giving employees the data-backed confidence to articulate value and justify the price to customers.

Key Facts

4x Revenue Growth

Companies that excel in four or more value elements (e.g., quality, saves time, reduces anxiety, and affiliation) see revenue growth four times greater (around 11.8% CAGR vs. roughly 2–5% for those with few or none).

Bain brief$1.1 billion in hidden profits

Ford's 2010 results attributed about $1.1 billion in extra quarterly profit to improved pricing alone—illustrating how better price realization can surface "hidden profit" without changing the product.

TheStreet coverage84% "First-Mover" Advantage

84% of buyers said the first vendor they contacted ultimately won the business, underscoring the payoff from decoding and communicating value early in the journey.

6sense summaryWhat is the Value Decoder framework?

The Value Decoder is a value-based pricing framework that decomposes how customers perceive value and converts that perception into a concrete price band, originally introduced by Rafi Mohammed's The Art of Pricing.

Instead of starting from your costs, it starts from what buyers see as their next-best choice and then adjusts for how your offer is better or worse and how context changes willingness to pay. At its core, the framework assumes that value is a subjective tradeoff between perceived benefits and perceived price.

-

Next‑Best Competitive Alternative (NBCA): The realistic option the customer would pick if they did not buy from you (e.g., a specific competitor, in‑house tool, manual workaround, or simply "do nothing" and continue current practice). This is your economic and psychological anchor. (See also: Economic Value Estimation for how NBCA is used in EVE.)

-

Product value differences: How your offer compares to the NBCA on things customers care about—brand, quality, attributes/features, service, convenience, and style/UX—and how much each of those differences is worth in dollars for the segment you're targeting.

-

Adjusting forces: External factors that shift willingness to pay even when the product itself hasn't changed—customer income/budget, prices of complementary products, and the broader market environment (fads, news, regulation, events).

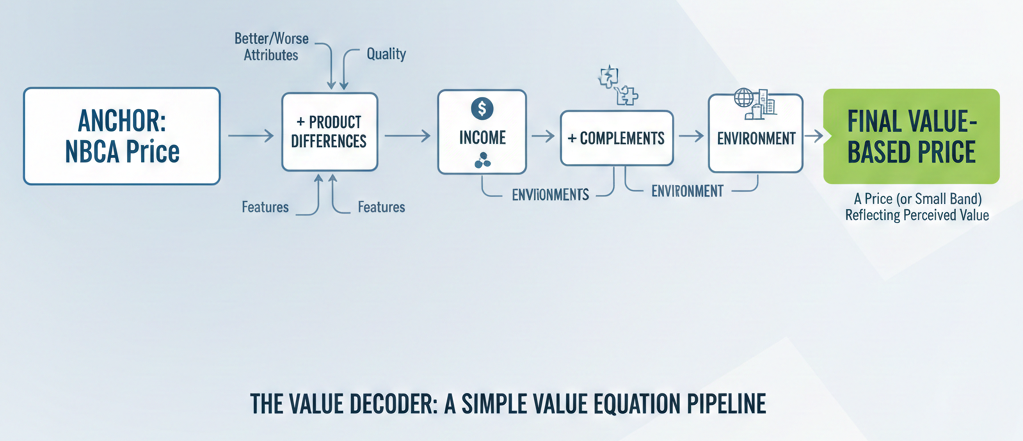

Mental model

Think of the Value Decoder as a simple value equation pipeline:

- Anchor: Start at the NBCA price.

- Decode product value: Adjust for how your product is better/worse along customer-relevant attributes.

- Decode context value: Adjust again for income, complements, and environment.

- Output: A price (or small band) that reflects current perceived value for a specific segment.

Why does the Value Decoder matter?

The Value Decoder is necessary because it gives teams a shared, concrete logic for turning fuzzy ideas about "value" into specific prices they can defend and improve over time.

-

Stop guessing or copying competitors: Moves you away from cost-plus pricing or "match the market" habits and toward prices grounded in how customers actually experience value.

-

Make value-based pricing operational: Breaks value into clear components (NBCA, product differences, income, complements, environment) and ties each to dollars instead of vague claims.

-

Align the company on one price story: Product, sales, finance, and leadership all see the same rationale for list prices, discounts, and tier gaps, which reduces internal conflict.

-

Spot hidden profit opportunities: Highlights segments, contexts, or moments (e.g., events, weather, trends) where willingness to pay is higher than your current price assumes.

-

React faster to market shifts: Provides a repeatable checklist for revisiting prices when competitors move, budgets change, or new information hits the market.

Value Decoder vs. Economic Value Estimation (EVE)

Economic Value Estimation (EVE) and the Value Decoder are both value‑based pricing frameworks that start from a competitive alternative and build up to a maximum justifiable price. The key difference: EVE asks what a fully informed "smart shopper" should pay based on economics, while the Value Decoder asks what a real‑world "beholder" will pay given perceptions, context, and timing.

| Dimension | Economic Value Estimation | The Value Decoder |

|---|---|---|

| Core question | "What is the maximum price a fully informed, rational customer should pay?" | "Given how people actually perceive this offer right now, what feels 'worth it'?" |

| Buyer lens | Smart shopper – fully informed, economically rational. | Beholder – subjective, influenced by context and snap judgments. |

| Core logic / formula | Reference value (NBCA price) + positive differentiation − negative differentiation. | Price of substitutes + 6 characteristics (brand, convenience, quality, attributes, service, style) + income, related products, environment. |

| Focus of value | Quantified economic utility (cost savings, revenue gains) plus some psychological value. | Perceived value mix – economic plus emotional, symbolic, and situational value. |

| Treatment of context | Usage and application; environment often handled via scenarios or sensitivity analysis. | Context is built‑in: fads, news, timing, weather, events, and other demand shocks directly shift recommended price. |

| Best use cases | B2B, high stakes, procurement; when you must justify a premium with hard numbers. | B2C, hybrid, or volatile markets; when perception, symbolism, and timing drive large price deltas. |

| Typical output | Detailed value stack and ROI argument to defend price. | Perception map and price band that highlights "hidden profits" and revenue leaks. |

In practice, EVE is the quantification and justification engine. It is ideal when selling to professional buyers who demand proof that your offer reduces costs or increases revenue, or when the End‑Benefit Effect is high and the cost of failure is large.

The Value Decoder is the perception and opportunity scanner. It explains why two offers with similar economics can support vastly different prices based on role, symbolism, or context, and it surfaces moments when value spikes (e.g., a sudden storm for umbrellas) but prices don't.

Founders often get the best results by combining both: use EVE to build the core economic logic beneath your price, then run the Value Decoder to align that price with how real humans actually experience value—and to decide where, when, and for whom you can charge more.

Decision criteria (When is the Value Decoder the right tool?)

| Situation | Use Value Decoder? | What to do |

|---|---|---|

| Clear, widely known competitors and prices | Very high | Works best when you can identify a realistic NBA. |

| New-to-world product but replacing a current workaround (e.g., spreadsheets, agency) | High | Treat the workaround (incl. time cost) as the NBA. |

| No obvious substitute, blue-ocean category | Lower | Use it to structure thinking, but rely more on WTP research (Gabor-Granger, conjoint, etc.). |

| Highly negotiated enterprise deals | Critical | Decoder gives list price / walk-away floor; deal desks then manage discounts. |

| Commodities with transparent market prices | Limited | Price is mostly set by market; focus on differentiation or other pricing tools. |

Use the Value Decoder when you have clear substitutes or alternatives to benchmark against and when perception, context, and timing significantly influence willingness to pay, especially for B2B and B2C products where market conditions change frequently.

How do you implement the Value Decoder step-by-step?

Inputs you need

-

Customer & segment: Who you're pricing for (industry, size, role, use case, geo); key jobs-to-be-done and pain points; basic firmographics/demographics (income or budget levels, region, industry).

-

Competitive & NBCA: Realistic alternatives (top 2–3 rivals, DIY, "do nothing"); their actual prices (transaction or street prices, not just list); simple attribute comparison plus win/loss and review insights.

-

Value & WTP signals: Customer interviews or surveys about what they value and why; any pricing research you have (Van Westendorp, Gabor‑Granger, conjoint, A/B tests); rough ROI metrics (time saved, revenue uplift, cost savings) to anchor monetary value.

-

Context & environment: Income/budget trends, prices of key complements (accessories, services, usage‑based costs), and market signals (competitor price moves, new entrants, regulation, hype cycles, local events).

Methods

-

Feed in research (Van Westendorp, Gabor‑Granger, conjoint, discrete choice experiments) and internal data (win rate vs. price, discounting patterns, churn by cohort) to refine attribute premiums/discounts.

-

Check outputs against unit economics (CAC payback, gross margin, contribution margin) so the value-based price is also financially sustainable.

-

Discrete Choice Analysis: Simulating the buying experience by presenting sets of product options and prices to see which combinations customers choose.

Step-by-step

Identify substitutes (NBCA)

Start by clearly naming the offer and segment you are pricing for, then list what your target customers would realistically buy or do if your product were unavailable—top competitors, in‑house tools, manual workarounds, or "do nothing." For each, determine the net price they actually pay (after discounts, bundles, usage fees), and choose the most realistic next‑best competitive alternative (NBCA) as your anchor.

Compare characteristics

Take your chosen NBCA and compare it against your product across the six characteristics—Brand, Convenience, Quality, Attributes, Service, and Style/UX—from the customer's point of view. For each area, decide whether you are better, equal, or worse, then assign a dollar premium for advantages and a dollar deduction for weaknesses, ideally as a low/base/high range informed by interviews, ROI estimates, or WTP research; summing these gives a baseline value premium or discount versus the NBCA.

Analyze income effects

Ask whether anything has meaningfully shifted your segment's income or budget—tax credits, economic boom or slowdown, new budget cycles, layoffs, or funding rounds—and how that changes their willingness to pay for your category. If income or budget has risen, you may be able to move toward the higher end of your value‑based range; if it has fallen, adjust downward to stay within what feels affordable while still respecting your cost and margin floors.

Evaluate related products (complements)

Identify the key products or services your customers buy alongside your offer—accessories, services, travel, usage‑based infrastructure, or other tools in their stack—and check whether their prices have increased or decreased. If complements have become more expensive, your customers' total solution cost has gone up and your share of wallet may need to come down; if complements are cheaper, you may have room to nudge your price upward without the overall bundle feeling out of line.

Monitor the environment

Scan the broader environment for fads, new information, regulation, seasonality, and one‑off events that could change perceived worth: a new diet trend, a viral news story, a conference in town, unusual weather, or a sudden shift in norms or regulation. Translate these into temporary or structural adjustments (e.g., a short‑term premium during a demand spike, or a protective discount while trust is low) and document your reasoning so it can be revisited.

Synthesize and present

Combine the NBCA anchor, characteristic‑based premium/discount, and the income, complements, and environment adjustments into a clear value‑based price band, then choose a list price (often at the mid–upper end) and discount guardrails (near the lower end, consistent with margin constraints). Present this logic to product, sales, finance, and leadership so everyone shares the same story about why the price is justified and when it can move, which builds confidence to hold price, negotiate effectively, and rerun the Decoder when conditions change.

Metrics to monitor

Price realization

Actual average selling price vs. list price; tracks discounting discipline.

Win/Loss Ratio per Segment

Tracking if high-value segments are defecting due to price, which indicates a value communication failure.

Operating Margin

Specifically looking for increases driven by price realization rather than cost-cutting.

Risks & anti-patterns

| Pitfall | Fix |

|---|---|

| Picking the wrong NBCA: You benchmark against a product customers rarely consider (too premium, different use case). | Use win/loss data: Use win/loss, interviews, and sales feedback to identify the real substitute (often "do nothing" or a scrappy workaround). |

| Double-counting value: The same benefit is counted under multiple attributes (e.g., "brand" and "quality" and "service"), inflating the premium. | Tie each attribute to distinct benefits: Tie each attribute adjustment to a distinct, customer-verifiable benefit or ROI story. |

| Ignoring segment differences: You average across very different buyers (SMB vs. enterprise, budget vs. premium), producing a price that fits no one well. | Run separate analyses per segment: Run separate Value Decoders for major segments; design differentiated offers and price fences to separate them. |

| Not revisiting after shocks: Competitor price war, recession, or hype wave changes value perception but your list prices stay stale. | Define trigger-based reviews: Define triggers (e.g., competitor changes price ±10%, major macro event) that automatically prompt a fresh Value Decoder run. |

References & Links

Sources:

- Mohammed, R. (2010). The 1% windfall: How successful companies use price to profit and grow. New York, NY: HarperBusiness. Link

- Mohammed, R. (2005). The art of pricing: How to find the hidden profits to grow your business. New York, NY: Crown Business. Link

- Simon-Kucher & Partners. (2021). Global pricing study. Retrieved from Simon-Kucher

- Nagle, T. T., Hogan, J. E., & Zale, J. (2016). The strategy and tactics of pricing: A guide to growing more profitably (5th ed.). New York, NY: Routledge. Link

- Baker, W. L., Marn, M. V., & Zawada, C. C. (2010). The price advantage (2nd ed.). Hoboken, NJ: John Wiley & Sons. Link

- Raju, J. G., & Zhang, Z. J. (2010). Smart pricing: How Google, Priceline, and leading businesses use pricing innovation for profitability. Upper Saddle River, NJ: Pearson. Link

Related pages: Value-based pricing | Economic Value Estimation (EVE) | Customer Use Cases | Van Westendorp Price Sensitivity Meter | Gabor‑Granger price testing | Conjoint analysis / discrete choice experiments | Good–Better–Best (GBB) packaging | Differential pricing & price fences

Frequently Asked Questions

How is the Value Decoder different from simple competitor benchmarking?

Competitor benchmarking highlights price gaps but rarely explains why they exist or whether they're justified. The Value Decoder forces you to make value drivers explicit (brand, features, service, context), translate them into dollars, and adjust for external forces. It's a structured value-based method, not a copy-the-competitor shortcut.

How is the Value Decoder different from Economic Value Estimation (EVE)?

EVE asks what a fully informed "smart shopper" should pay based on economic utility and builds a quantified value stack to justify a premium—great for B2B and procurement. The Value Decoder asks what a real-world "beholder" will pay given perception, income, complements, and environment—better for understanding context-driven price swings and hidden profit pockets. In practice, teams often use EVE for hard economics and the Value Decoder for perception and timing.

Can I use the Value Decoder without formal WTP research?

Yes—as a starting point. Many teams begin with qualitative inputs (interviews, sales feedback, time-saved estimates) to rough in attribute premiums/discounts. The framework works with judgmental inputs, but even light research (simple surveys, A/B tests) makes the dollar adjustments more defensible.

Can I use the Value Decoder for a completely new, revolutionary product?

Yes, but you must be disciplined about the reference point. Identify the best "do-nothing" or workaround alternative and estimate its full economic cost (time, errors, risk). Treat that as the NBCA, then use pilots and early adopters to refine the attribute values and validate whether your initial price band feels right.

How often should we rerun a Value Decoder analysis?

At least annually for core products, and more often when big triggers hit: major competitor price moves, macro swings (recession, inflation spikes), large product launches, or consistent sales feedback that "price is an issue." For fast-moving SaaS or consumer categories, quarterly check-ins or trigger-based reviews work well.

What if my product has no obvious direct competitor?

There is almost always an NBCA: the status quo, doing nothing, or a workaround that solves the same job. Estimate the full cost of that option (labour, delays, risk), convert it into an economic value per period, and use that as your anchor before layering on the Value Decoder adjustments.

What is the role of the sales team in this framework?

Sales is both an input and an output. They provide rich insight into real NBCA choices, perceived strengths/weaknesses, and where buyers push back on price. Once the Decoder is run, sales should be trained on the value story behind each attribute premium and given clear guardrails (target price, discount floor) so they can defend value in negotiations instead of defaulting to discounts.

Ready to build a powerful revenue engine?

Stop guessing and start growing. Let's build a monetization strategy that unlocks your startup's true potential.

Book Your SprintReuse & Attribution

This content is available for reuse with attribution. When referencing or republishing, please credit Dr. Sarah Zou and link back to the original source.

Licensed under Creative Commons Attribution 4.0 International. You are free to share and adapt this material, provided you give appropriate credit.

Category

Understanding Value & CustomersLast Updated

December 29, 2025

Reading Time

8 minutes

Tags

Dr. Sarah Zou

EconNova Consulting

PhD economist specializing in pricing and monetization strategy for tech startups. Helping startups and scale-ups optimize their pricing for maximum growth.

Learn more about Sarah →Need help with your pricing strategy?Book a consultation →