Jobs to Be Done (JTBD)

A demand lens that defines customers' 'progress' in context, so you can shape messaging, onboarding, packaging, and pricing around real switching triggers.

Snapshot (TL;DR)

What it is

JTBD describes why customers buy or churn by identifying the job they "hire" a product to do in a specific situation.

Why it matters

- Predictable demand: Jobs already exist; you're aligning to a current of demand rather than inventing one.

- Faster sales + fewer discounts: Job-aligned packaging makes value obvious and reduces explanation.

- Cleaner product lines: Avoid monoliths (overbuilt bundles) and hydras (unmanageable module sprawl) by bundling around jobs.

When to use

- Early: shaping a value proposition, positioning, or category story

- Growth stalls: diagnosing churn, low conversion, or heavy discounting

- Pricing & packaging: designing plans, picking a value metric, or adding tiers/fences by stakes/context

- Product direction: deciding what to build next based on real switching triggers

Key Takeaways

Context is Queen: The "when" and "where" matter more than the "who"; People with different titles can share the same job.

Competition is broader than your category: You're competing with spreadsheets, agencies, internal hacks, and "do nothing," not just direct rivals.

Switching is emotional + rational: The Push/Pull/Habit/Anxiety forces explain why customers stall—even when value is obvious.

Packaging and pricing follow the job: Align tiers, fences, and the value metric to the customer's unit of progress; then validate willingness-to-pay.

Key Facts

75% failed

Research indicates that 75% of venture-funded startups fail, often because they lack a well-aligned price for their chosen buyer or solve a "problem" that isn't a "job".

Harvard Business Review86% success rate

In a reported study of ODI/JTBD projects, 18 of 21 launches were rated successful (86% success rate).

Why do innovation projects fail?Less Pricing Sensitive

In B2B software, value drivers and specific jobs are more important than price which is typically only the third to seventh most important factor in a purchase decision.

Price to ScaleWhat is Jobs to Be Done (JTBD)?

The Jobs to Be Done (JTBD) theory, pioneered by Clayton Christensen, a Harvard Business School professor, asserts that customers do not buy products; they "hire" them to perform a specific "job".

A "job" is distinct from a mere "problem." While a problem is a situation a user doesn't want to be in, a job requires intentionality—a clear desire to move from a current state "A" to a desired state "B". To have effective demand, the customer must be actively searching for a solution or have an intention to get the task done.

Key definitions

- Job executor: The person who experiences the struggle and decides to "hire" a solution (may differ from payer/admin in B2B).

- Job statement (functional core): Help [actor] [make progress] in/when [circumstance] despite [constraints].

- Job story (format): When ___, I want to ___, so I can ___.

- Desired outcomes (ODI lens): Metrics the customer uses to judge success (speed, effort, reliability, risk, compliance).

Why do Jobs to Be Done matter?

For startup founders, JTBD is the bridge between understanding customer demand and designing products, pricing, and messaging that align with real switching triggers.

-

Predictable Demand: A package built around a job taps into a pre-existing stream of demand. As one entrepreneur noted, it is like "holding your cup out—the water was already running".

-

Efficiency in Sales: Aligning packaging with specific jobs makes the product instantly understandable to the buyer, which reduces sales cycles and minimizes the need for heavy discounting.

-

Portfolio Integrity: Using JTBD prevents the creation of "Monoliths" (overengineered products that deliver too much functionality for most users, leading to under-monetization) and "Hydras" (products that grow in unmanageable complexity because every new feature is spun out as a new module).

Mental model

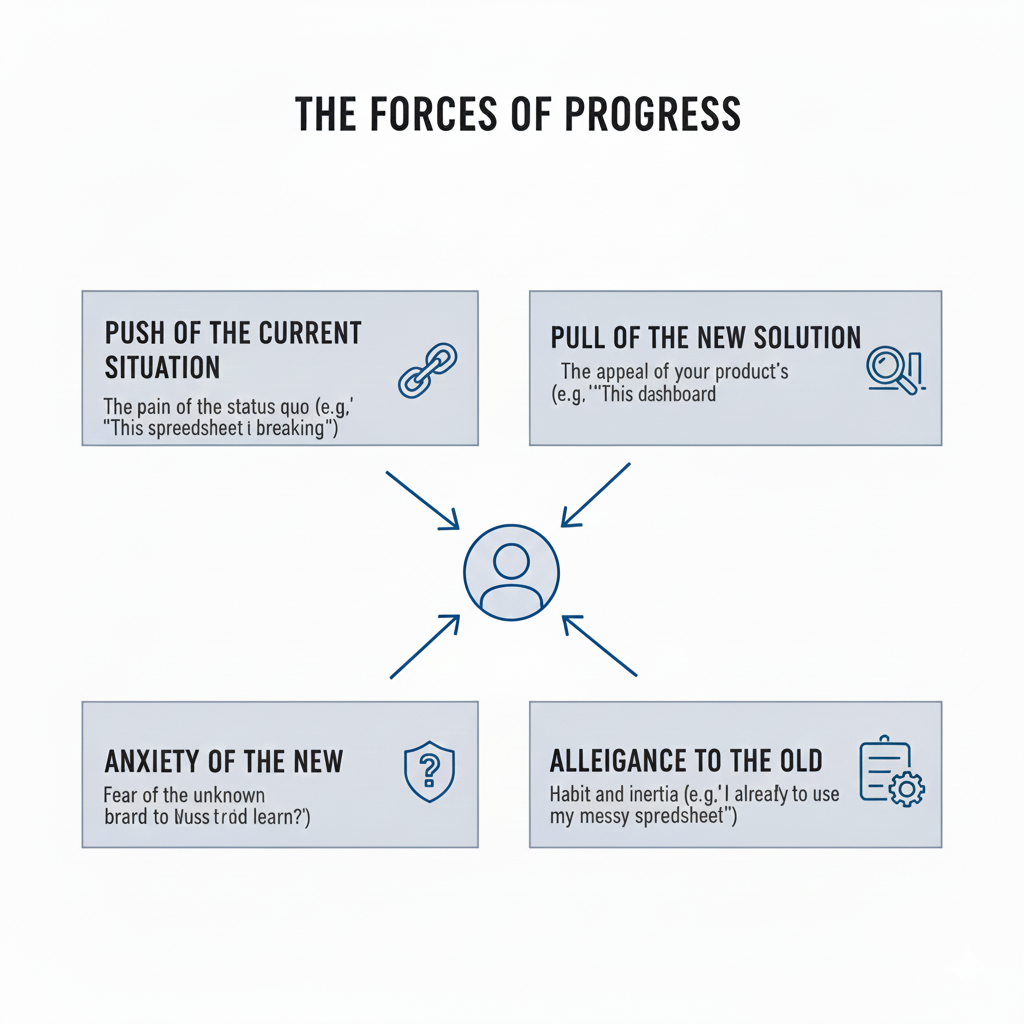

The Forces of Progress

To understand why a customer "hires" your startup, you must look at the four forces acting on them at the moment of purchase:

- Push of the Current Situation: The pain of the status quo (e.g., "This spreadsheet is breaking").

- Pull of the New Solution: The appeal of your product's promise (e.g., "This dashboard looks effortless").

- Anxiety of the New: Fear of the unknown (e.g., "Will this be hard to learn?").

- Allegiance to the Old: Habit and inertia (e.g., "I already know how to use my messy spreadsheet").

Rules of thumb

Interview count

Approximately 90% of key customer needs can be identified by conducting just 10–12 in-depth interviews per market segment. (source: The Strategy and Tactics of Pricing)

The Drill/Hole Maxim

"People don't want a quarter-inch drill; they want a quarter-inch hole."

The "Workaround" Rule

If you see people using a tool for something it wasn't intended for (e.g., using Excel as a CRM), there is a massive JTBD opportunity there.

How to Apply It

Inputs you need

- 10–15 recent "hired" or "fired" customers (bought or churned in the last ~90 days)

- A place to observe real work (screenshare, ride-along, session replays) to see where they struggle

- Context notes: team setup, stakes (deadlines/risk), constraints (security/compliance), who approves (B2B)

- Light product data: time-to-first-value, retention, key activation events

Methods

- Unstructured interviews (10–15): Talk to recent buyers and churners; start with the trigger struggle and capture their words.

- Observation: Watch users in their natural workflow to spot friction, workarounds, and hidden constraints.

- Switch interviews: Deep-dive the timeline (first thought → evaluation → decision → onboarding) to surface Push/Pull/Habit/Anxiety.

- Synthesis (fast): Turn notes into Job Statements and a simple Forces map, then translate into product/messaging/onboarding changes.

Step-by-step

Identify the Struggle

Ask: "What happened that made you realize you needed a change?" Note the context, stakes, and current workaround.

Write the Job Statement

Use the formula: [Action] + [Object] + [Context]

- Example: "Organize (Action) my team's tasks (Object) when we are all working remotely (Context)."

Map the Forces

Identify what is pushing them toward you and what is keeping them stuck.

- Push: what's broken now?

- Pull: what's attractive about the new?

- Habit: what keeps the old?

- Anxiety: what scares them about switching?

Design for the Job

Align your features, marketing copy, and onboarding specifically to address that "Progress."

- Product: prioritize what removes struggle and improves outcomes.

- Messaging: lead with context + progress (not features).

- Onboarding: get them to the first job-complete moment fast.

- Packaging/pricing: pick a value metric that matches the job; add fences for higher-stakes contexts.

Metrics to monitor

Time-to-value (TTV)

How quickly does the user realize the "progress" they were looking for? (time from signup to first job-complete moment)

Job completion rate / Success Rate

How often can the user complete the "job" using your tool?

Retention by job segment

Cohort retention by primary job

Risks & anti-patterns (and how to fix them)

| Pitfall | Fix |

|---|---|

| Treating jobs like personas: Segmenting by titles or company size instead of context and stakes. | Segment by context + stakes + constraints (and job frequency). Titles/company size are secondary. |

| Writing solution-y job statements: Using product words in job statements (e.g., "Use dashboards to…"). | Rewrite to [Action] + [Object] + [Context] with no product words; validate against workarounds and "do nothing." |

| Skipping the forces: Hearing "looks great" but deals stall without understanding why. | Always map Push / Pull / Habit / Anxiety and design proof to reduce anxiety (templates, ROI calc, security docs, references). |

| Interviewing only happy customers or power users: Missing insights from customers who didn't succeed. | Include recent churn, lost deals, and recent switchers; switching reveals real criteria and fears. |

| Packaging by feature buckets, not jobs: Organizing plans by features like "Analytics," "Automation," "Integrations." | Bundle around jobs and stakes; put "must-have to complete the job" features in the tier where that job lives. |

| Calling every loss "too expensive": Assuming price is always the issue when deals are lost. | Diagnose the quality of the no: was it the wrong job fit, unclear proof, wrong value metric, or missing fence (e.g., SSO/SLA/audit logs)? |

References & Links

Sources

- Christensen, C. M., Hall, T., Dillon, K., & Duncan, D. S. (2016a, September). Know your customers' jobs to be done. Harvard Business Review.

- Christensen, C. M., Dillon, K., Hall, T., & Duncan, D. S. (2016b). Competing against luck: The story of innovation and customer choice. HarperBusiness.

- Ghuman, A., & Pasternak, J. (2021). Price to scale. Paget Publishing.

- Lehrskov-Schmidt, U. (2023). The pricing roadmap. (Self-published).

- Moesta, B., & Dander, G. (2019). Demand-side sales 101: Stop selling and help your customers make progress. Re-Wired Group.

- Ramanujam, M., & Tacke, G. (2016). Monetizing innovation: How smart companies design the product around the price. Wiley.

- Ulwick, A. W. (2005). What customers want from your products. Harvard Business Review, 83(1), 70–82.

- Ulwick, A. W. (2016). Jobs to be done: Theory to practice. Idea Bite Press.

Related pages: Value Metric | Packaging & Bundling | Price Fences | Segmentation | Customer Use Cases | Willingness-to-Pay

Frequently Asked Questions

How do I know if I have a "job" or just a "problem"?

A job has intentionality. If you look at your market and people are already spending money or significant time trying to solve it, it's a job.

Is JTBD just another name for personas?

No. Personas describe who; JTBD explains why now (context + progress + tradeoffs).

Can JTBD work in B2B with multiple stakeholders?

Yes—model executor, buyer, approver separately and map their anxieties (security, risk, budget).

How does JTBD connect to pricing?

Jobs reveal the customer's unit of progress → informs value metric, packaging, and fences; then quantify with WTP research.

Should I put my newest, most advanced features in my highest tier?

Not necessarily. If a feature is essential to solving the specific job of a lower tier, put it there to ensure the customer gets value. Differentiate your tiers by the jobs they solve, not just by feature count.

What's a quick sign we picked the wrong job?

Your "competition" list looks narrow (only direct rivals) and your messaging is feature-heavy rather than outcome/constraint-driven.

Ready to build a powerful revenue engine?

Stop guessing and start growing. Let's build a monetization strategy that unlocks your startup's true potential.

Book Your SprintReuse & Attribution

This content is available for reuse with attribution. When referencing or republishing, please credit Dr. Sarah Zou and link back to the original source.

Licensed under Creative Commons Attribution 4.0 International. You are free to share and adapt this material, provided you give appropriate credit.

Category

Understanding Value & CustomersLast Updated

December 30, 2025

Reading Time

8 minutes

Tags

Dr. Sarah Zou

EconNova Consulting

PhD economist specializing in pricing and monetization strategy for tech startups. Helping startups and scale-ups optimize their pricing for maximum growth.

Learn more about Sarah →Need help with your pricing strategy?Book a consultation →