SaaS Benchmark Data Sources Guide | Stage-Smart Metrics for 2024-25

As SaaS founders, have you faced that moment before a board meeting or investor call—scrambling to justify your metrics, unsure if you're comparing apples to apples?

The SaaS Benchmark Problem

73% of SaaS founders cite benchmark confusion as a major pain point in investor communications. The issue? Too many sources, some outdated or too generic, conflicting definitions, and stage-inappropriate comparisons.

The solution: This guide helps you match the right benchmark sources to your specific stage and funding / business model.

Want the hi-res, print-ready PDF version of this SaaS Benchmark Source Cheat Sheet—-complete with clickable links to the latest benchmark reports and original sources? Download it free here.

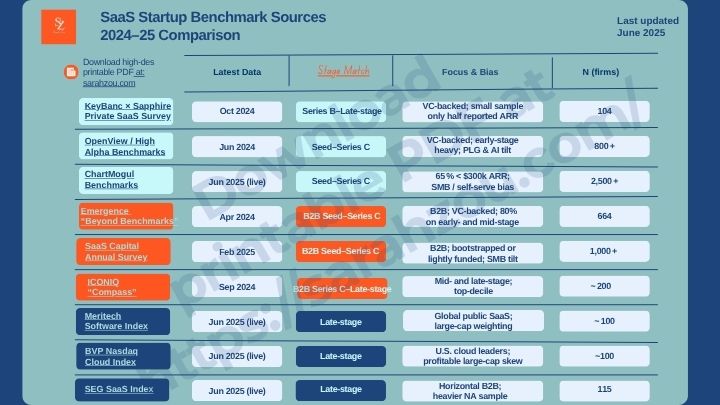

SaaS Benchmark Data Sources Guide

Use this framework to select credible benchmarking data for pitch decks and investor communications.

Seed to Series C: VC-Backed Focus

Critical Sources:

- KeyBanc × Sapphire - Growth-stage benchmarks; note that only half of the sample reported ARR.

- OpenView / High Alpha - >80% on early- and mid-stage.

- ChartMogul - Already using ChartMogul? Leverage their live benchmarks for churn, MRR, and retention.

When to Use:

- Early-stage fundraising

- Board presentations

- Growth strategy validation

B2B SaaS: Enterprise-Grade Metrics

Critical Sources:

- Emergence - Enterprise-leaning, U.S./enterprise cloud focus.

- SaaS Capital - Heavy SMB / lower-middle-market tilt.

- ICONIQ Compass - Unicorn-stage metrics; over-represents top-decile.

Stage-Specific Guidance:

- Early-stage & VC-backed? → Use Emergence for enterprise-grade KPIs.

- Bootstrapped or lightly funded? → Reference SaaS Capital for capital-efficient expectations.

- Scaling past Series B? → Leverage ICONIQ Compass for unicorn-stage metrics.

Series D, Pre-IPO & Exit: Public Market Alignment

Critical Sources:

- SEG SaaS Index - M&A comparisons; focus on horizontal B2B; heavier North-America sample.

- Meritech Software Index - Public market multiples.

- BVP Cloud Index - Public-market cloud/SaaS index; valuation multiples skew toward profitable leaders.

- ICONIQ Compass - Late-stage enterprise cloud; over-represents top-decile.

Pro Tips for Credible Benchmarking

-

Source Multiple Data Points When metrics differ by more than 15% across sources, cite at least two and clarify the definition (e.g., New CAC Ratio vs Blended).

-

Definition Clarity For example, always specify:

-

CAC Type: New vs. Blended vs. Total

-

Retention Period: Monthly vs. Annual

-

Revenue Recognition: GAAP vs. Non-GAAP

Common Benchmarking Mistakes

❌ What Not to Do:

- Using public SaaS metrics for early-stage companies

- Comparing B2C retention to B2B benchmarks

- Mixing different CAC calculation methodologies

- Citing outdated (pre-2024) benchmark data

✅ What to Do Instead:

- Match benchmarks to your exact stage, funding status, and pricing / business model

- Use multiple sources and explain discrepancies

- Update benchmarks quarterly

- Provide context for your specific business model

The Bottom Line

Quality benchmarking isn't about finding the highest numbers—it's about telling a credible story that aligns with your stage and investor expectations.

The right benchmarks help you:

- Justify your metrics with confidence

- Identify improvement opportunities

- Align investor expectations

- Build credibility in fundraising conversations

Need help tailoring these benchmarks to your specific situation?

I help SaaS founders craft stage-smart, investor-aligned metrics narratives that close the gap between data and valuation. Book a free consultation to discuss your benchmark strategy.

Want more insights on SaaS metrics and investor communications? Subscribe to my newsletter for weekly strategic advice.